What you need to know about Flood Insurance on Folly Beach, SC.

Everyone has a goal of owning a home in paradise, but living on a barrier island can come with some challenges. One of frequently asked issues is figuring out how to deal with rising water, whether it is recurring or part of a major storm event. There are several factors that can affect both insurance premium amounts and property damage resulting from the risks of flooding, and there are several ways to decrease your risks. Learning more is crucial when you are looking to buy on Folly Beach or protecting the property you own. Below is a guide to learn the basics of these factors, and I highly recommend enlisting an expert who has helped many people insure their favorite asset, their beach home. Contact me to find a professional.

Location

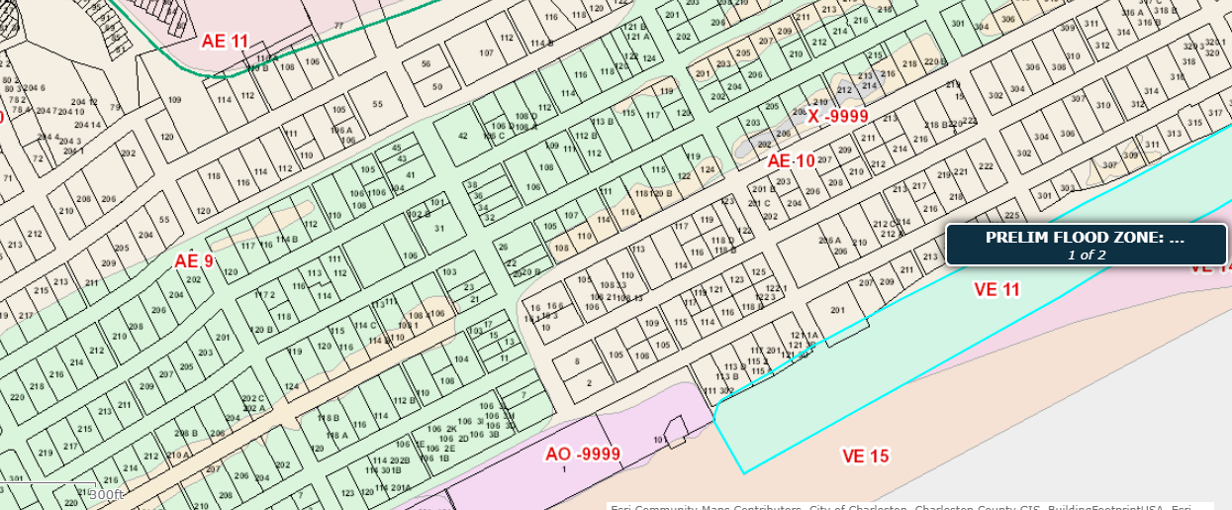

A good place to start is to identify which flood zone the property sits in. They can vary from VE which is the most vulnerable to X which is a low level of risk of a flood. You will find VE properties on the oceanfront and on the Folly River, and you will be hard pressed to find one in an X zone. The majority of the island sits in an AE flood zone. You can get the best descriptions of these zones on the FEMA website. Here is an image of Center Street on Folly Beach labeled with different flood zones. When seeking a property, finding out the current flood zone is the first step.

Elevation

“How high am I?” is a question you will hear alot on Folly. Your flood zone plus the elevation of your home will be the biggest determining factor of insurance premiums and safety from property damage. You will see these as the numbers associated with each particular flood zone. For example an AE 10 is an AE flood zone with a Base Flood Elevation of 10 feet. The Base Flood Elevation (BFE) is set by FEMA and the current building code requires the lowest structural member of the home must be 1 foot above BFE. You will see that most homes built in the last decade or so are elevated and would have had to build to this standard which will carry lower risks of damage. There are many older homes on the island that will require an elevation certificate to determine the elevation of the home. An elevation certificate is performed by a surveyor, and the owner could have one in their possession or a new one can be ordered. You would want to have one that has been done within the last few years or so. To keep it simple, if your elevation is below the BFE, you will be rated as a higher risk of damage during a flood event.

How do I buy flood insurance for Folly Beach?

Your insurance agent can write a flood policy for you up to $250,000 coverage which is guaranteed by FEMA. If you are interested in covering greater than $250,000, for instance your mortgage is higher than that and your bank is requiring the coverage, then you will need to find a secondary excess coverage policy. There are many private carriers who offer this product and they are becoming more competitive and attractive on Folly Beach. It could even benefit you to write the entire coverage through one company. This is where it is crucial to work with an expert who specializes in these types of coverages. There are insurance firms who know Folly Beach and the available carriers like the back of their hand, and agents from off the island may not have the resources to compete. Trust the Expert! Contact me for more information.

Folly Beach’s Community Rating

The National Flood Insuarance Program (NFIP) has a community rating system (CRS) to recognize and encourage community floodplain management activiities exceeding the minimum NFIP standards. They look for a community to meet three goals (1) reduce flood damage to insurable properties, (2) strengthen and support the insurance aspects of the NFIP, and (3) encourage a comprehensive approach to floodplain management. CRS Classes range from 9 to 1 with 1 being the best. Folly Beach has worked incredibly hard to improve the City’s rating and increased their rating to a level 4 in 2018 which translates into 30% insurance premium savings for the residents. Thank you Folly! They also have a tremendous informational resource on their website, learn even more here.

This guide should serve as an introduction to the factors needed to reduce the risks of property damage and to find lower insurance premiums on Folly Beach. I am happy to talk more about it anytime or recommend a professional to acquire insurance guidance, just contact me and ask away!